Retroactive Payment Calculation FAQ?s

How to Calculate Your Retroactive Payment per Child

Q1: What do I need to calculate my retroactive payment per child?

A1: You will need the following:

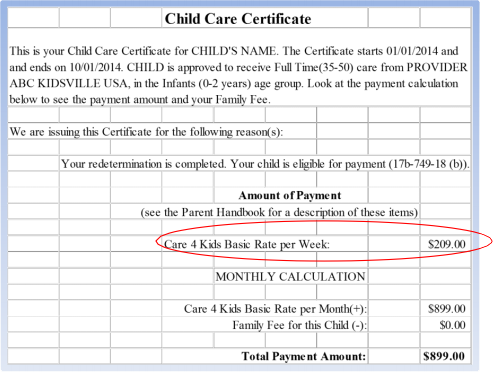

- The child care certificate covering the retroactive payment period:

- ?2002 Payment Rate Table (Click here to see the 2002 rates?)

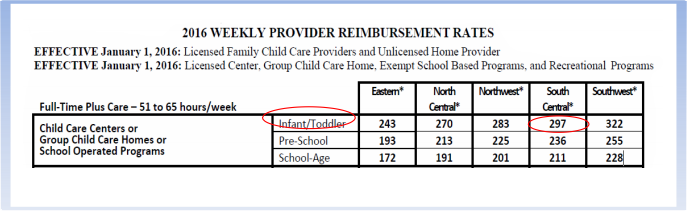

- New 2016 Payment Rate Table (2016 Weekly Reimbursement Rates)

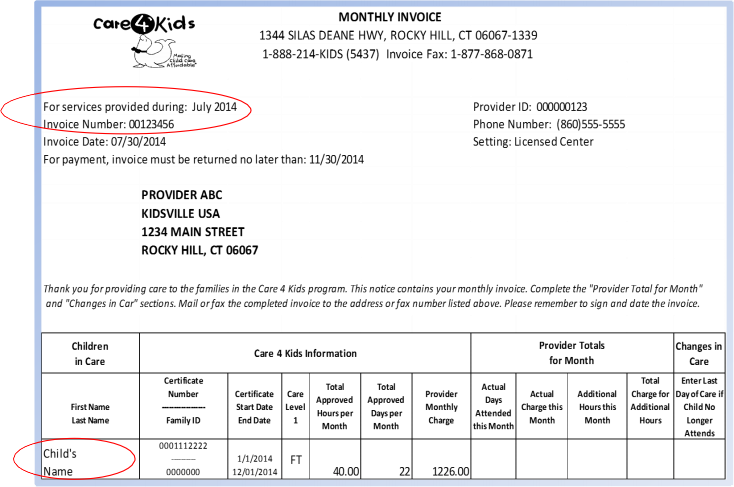

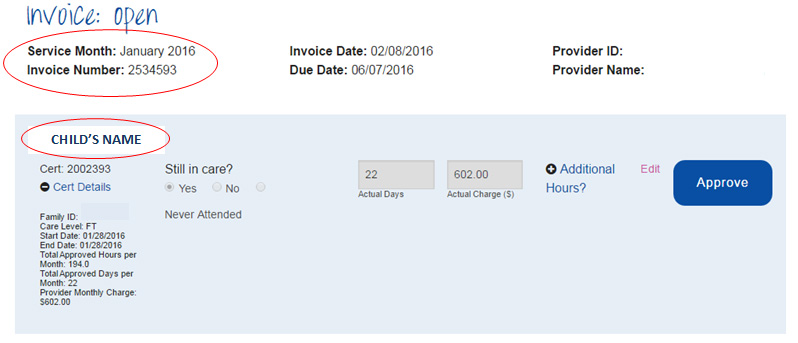

- Monthly Invoice covering the retroactive payment period

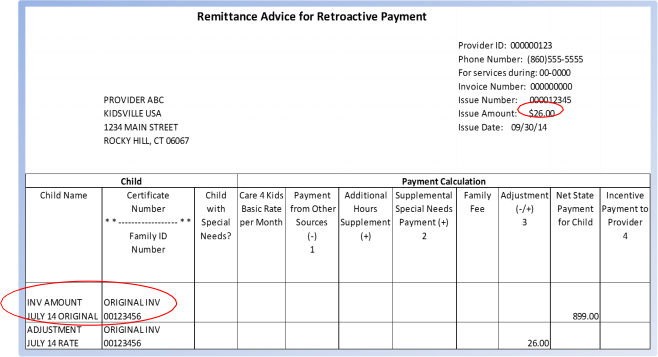

- Remittance Advice for retroactive payments

Q2: How do I breakdown my retroactive payment per child?

A2: Step 1: Obtain the original invoice number, payment month and corresponding total retroactive payment from the retroactive payment Remittance Advice you received in the mail.

Step 2: Refer to your original paper invoice or electronic invoice for a breakdown of the individual children that were paid.

PAPER INVOICE

?

ELECTRONIC INVOICE

Step 3: Compare your 2002 C4K basic rate per week as indicated on the Child Care Certificate to the new 2016 Payment Rate Table.

Step 4: Take the difference of the rates and multiply it by 4.3 weeks to obtain the retroactive monthly payment amount.

Example:

NEW 2016 Basic Rate per week for a Licensed Center in the South Central region at the Full-Time Care level for an Infant Child??..?$297.00 per week

2002 C4K Basic Rate per week for a Licensed Center in the South Central region at the Full-Time Care level for an Infant Child???$209.00 per week

$297.00 minus $209.00 = a difference of $88.00 per week between the old and new rate.

$88.00 multiplied by 4.3 weeks = $378.00

$378.00 is the retroactive payment for that child*

*If you are a member of CSEA-SEIU Local 2001 labor union, your union dues will be deducted from the retroactive payment and the original payment amount.

* If your program is accredited, the accreditation incentive will be included in your retroactive payment.